Repayments#

To enlarge any images in this document, right click on the image and open in a new tab.

Repayments For Reverse Factoring Finance Scheme#

Funding payback by the Purchaser#

Purchaser needs to pay the funding amount to the financier by the due date. This can be done by executing the payment cycle from the purchaser’s side and marking the cash-flow status to ‘success’ after manually completing the payment. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Financeable Amount Pay by the Financier(Xero Account)#

Financier needs to pay the Financeable amount to the Supplier by the Due Date. Once executing the payment cycle from the financier’s side, due payments will be listed related to that specific date. If the Financier is using XERO, payment can be initiated using XERO Batch payment option. After doing the payment from the XERO, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle. Please ensure that Payment Cycle is executed before moving to XERO to generate Batch Payments.

Residual Payment by the Purchaser#

Purchaser needs to pay the residual amount to the supplier by the invoice due date if the invoice limit is less than 100%. This can be done by executing the payment cycles from the purchaser’s side and marking the cash-flow status to ‘success’ after manually completing the payment. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Repayments for Factoring Finance Scheme#

Financeable Amount Pay by the Financier(Xero Account)#

Financier needs to pay the Financeable amount to the Supplier by the Due Date. Once executing the payment cycle from the financier’s side, due payments will be listed related to that specific date. If the Financier is using XERO, payment can be initiated using XERO Batch payment option. After doing the payment from the XERO, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle. Please ensure that Payment Cycle is executed before moving to XERO to generate Batch Payments.

Invoice payment by the Purchaser#

Purchaser needs to pay the Invoice amount to the financier’s DDA account on the invoice due date. This can be done by executing the payment cycle from the purchaser’s side marking the cash-flow status to ‘success’ after manually completing the payment. Please click on the link Payment Cycle Execution to see how to execute payment cycle and mark the status.

Funding payback by the Financier Manually#

Financier need to pay funding payback from financier’s DDA account to financier’s default account by executing payment cycle from the financier, 1 day after the invoice maturity date. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Funding payback by the Financier using Xero Account#

Financier need to pay funding payback from financier’s DDA account to financier’s default account. Once executing payment cycle from the financier , 1 day after the invoice maturity date. This payement can be done by Financier Xero Account. After doing the payement from the Xero Account, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Residual Payment by the Financier Manually#

Financier needs to pay the invoice residual to the supplier from the DDA account if the invoice limit of the financing scheme is less than 100%. This can be done by executing the payment cycle from the financier marking the cash-flow status to ‘success’ after completing the payment. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Residual Payment by the Financier using Xero Account#

Financier needs to pay the invoice residual to the supplier from the DDA account if the invoice limit of the financing scheme is less than 100%. This can be done by executing the payment cycle from the financier then After doing the payement from the Xero Account, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Repayments for Discounting Scheme#

Financeable Amount Pay by the Financier(Xero Account)#

Financier needs to pay the Financeable amount to the Supplier by the Due Date. Once executing the payment cycle from the financier’s side, due payments will be listed related to that specific date. If the Financier is using XERO, payment can be initiated using XERO Batch payment option. After doing the payment from the XERO, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle. Please ensure that Payment Cycle is executed before moving to XERO to generate Batch Payments.

Funding payback by the Supplier#

Supplier needs to pay the funding payback amount to the financier’s DDA account on the invoice due date. This can be done by executing the payment cycle from the supplier’s side and marking the cash-flow status to ‘success’ after manually completing the payment. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Funding payback by the Financier Manually#

Financier need to pay funding payback from financier’s DDA account to financier’s default account by executing payment cycle from the financier, 1 day after the invoice maturity date. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Funding payback by the Financier using Xero Account#

Financier need to pay funding payback from financier’s DDA account to financier’s default account.This can be done by executing payment cycle from the financier, 1 day after the invoice maturity date. After doing the payement from the Xero Account, platform will be updated the Cash-flow status into 'settled' automatically. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Platform Fee#

Platform fee is charged by the Sea Easy Capital platform from the Purchasers. The admin of the Sea Easy Capital platform set a Platform fee for the on-bordered purchasers from admin’s side. Purchasers can view the platform fee for financed invoices in the payment instructions of the invoice. Using the following steps purchaser can view the platform fee.

Click on invoices and click on payables (Fig 1), then you will be navigated to Fig 2

Fig 1 - Invoices

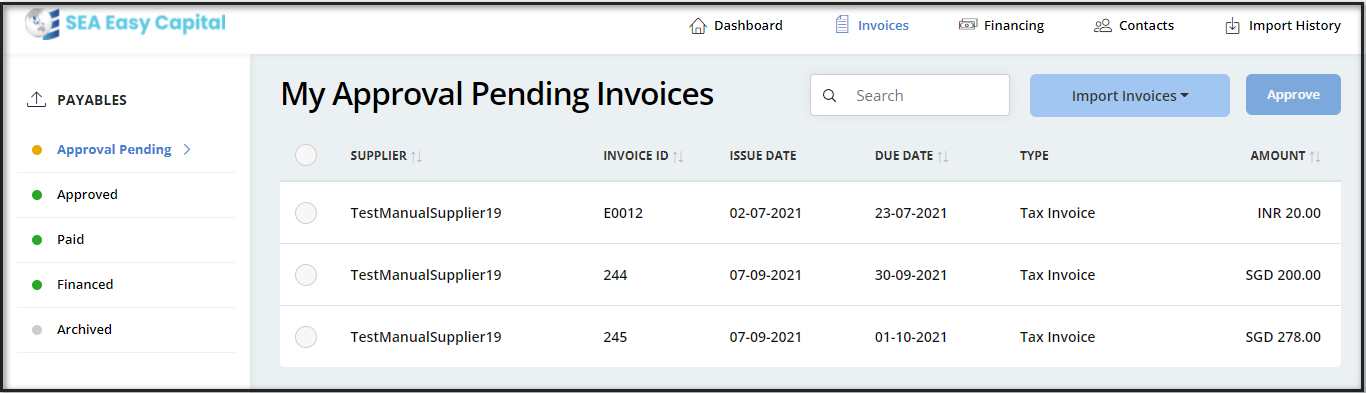

Fig 2 - Payables

Click on Financed from the left navigation and then you will navigate to Fig 3.

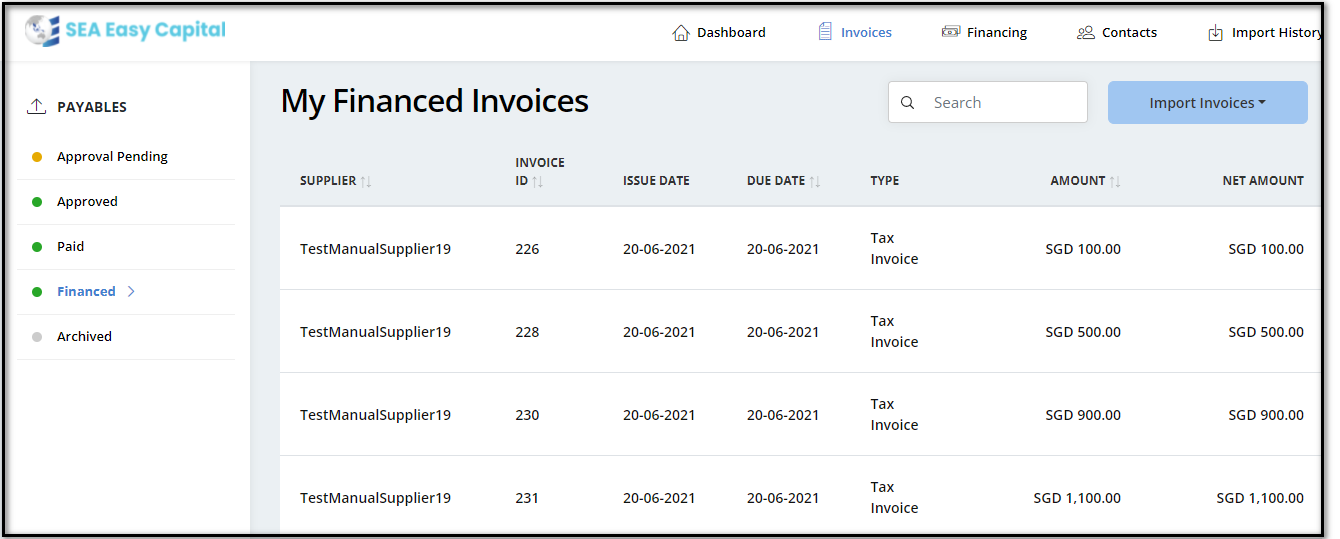

Fig 3 - Financed Invoices

Click on the selected invoice and you will navigate to Fig 4.

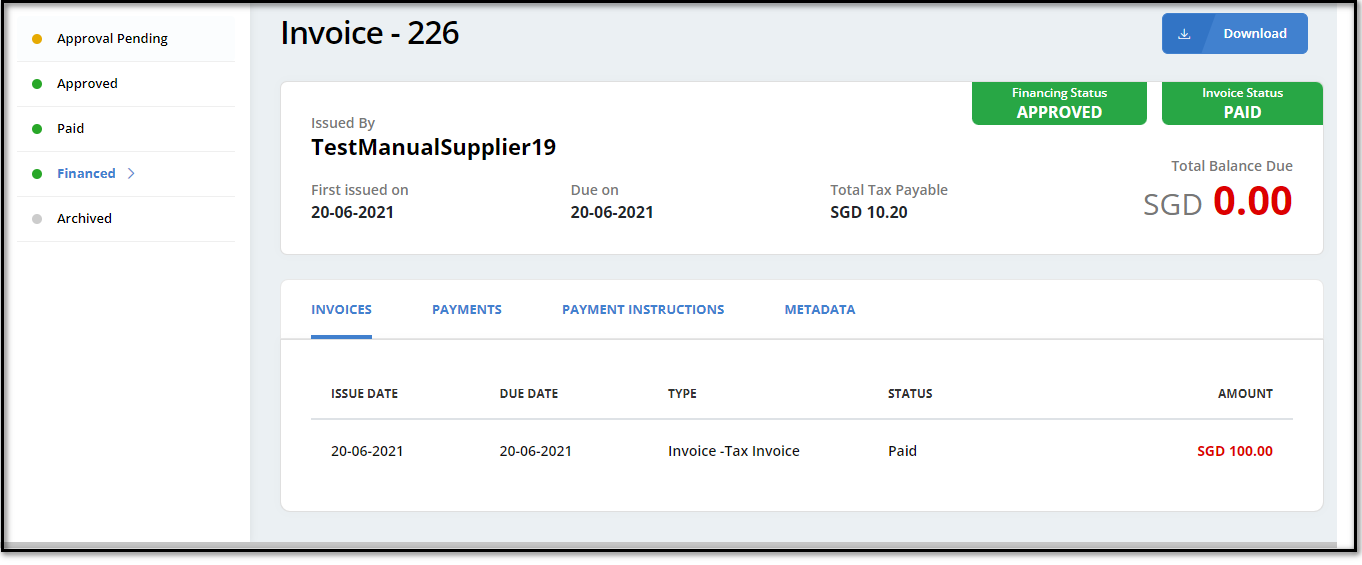

Fig 4 - Invoice

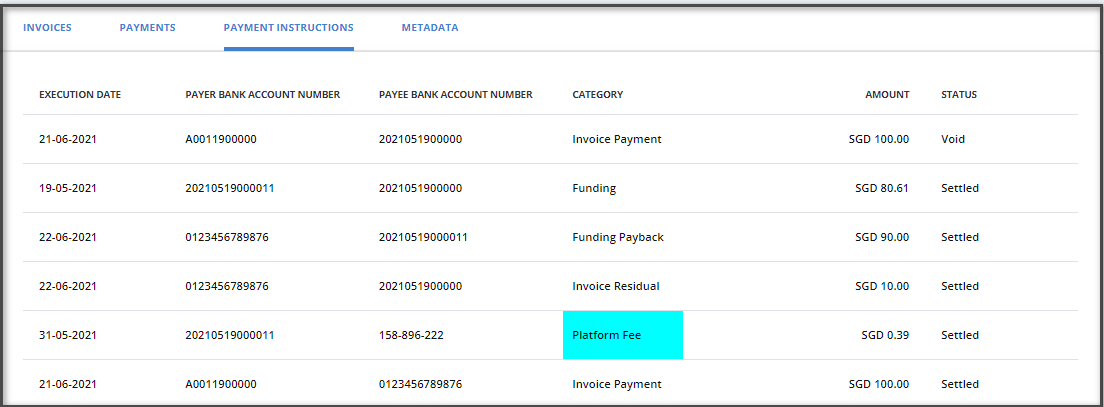

Click on the payment instruction tab and you can view the platform fee. (Fig 5).

Fig 5 - Platform Fee

Purchaser can execute the payment cycle and after manually do the payment to the platform at the end of the month and mark the status of the cash-flow record as ‘Success’ in the payment cycle.Please click on the link Payment Cycle Execution to see how to execute payment cycle and mark the status.

Service Charges#

Service charges are calculated according to the below formula.

Service charges = Financeable amount x platform fee% x (Facility duration / 365)

Services charges are levied once a calendar month, for all transactions that were executed for that calendar month. If the financier is using Xero, platform sets up a Bill on XERO for each transaction with a due date of end of that calendar monthh. Financier needs to pay the bill once a month to the platform for all the transactions done within that month. Please click on the link Xero to see how to integrate a Xero account to the platform.

If the financier is not using the Xero, service charges can be paid manually to the platform and execute payment cycle for that. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Note: Service Charges have been configured including some percentage by the Itelasoft Team. So for further changes or details, please contact team Itelasoft.

Other Charges#

Other charges are calculated according to the below formula.

Other charges = Financible amount x 5% x (Facility duration / 365)

If the financier is using Xero, platform sets up a Bill on XERO for each transaction with a due date of end of that calendar month. Financier needs to pay the bill once a month to the platform for all the transactions done within that month. Please click on the link Xero to see how to integrate a Xero account to the platform.

If the financier is not using the Xero, other charges can be paid manually to the platform and execute payment cycle for that. Please click on the link Payment Cycle Execution to see how to execute payment cycle.

Note: Other Charges have been configured including some percentage by the Itelasoft Team. So for further changes or details, please contact team Itelasoft. For example: 5%(in the above Other charges formula).